Beauty cosmetics market tide "fever"

Author | Cheng Jia

Edit | Tang Fei

Mao Geping, a listed "nail house", broke through the customs for 7 years and ended up with "failure".

From the "Mao Geping head-changing technique", which was once popular all over the network, it is rarely out of the circle now. It was not until the topic "Mao Geping withdrew its IPO application" rushed to the hot search that the brand was able to regain the attention of the outside world.

In recent years, overseas brands have withdrawn from the China market, and some local beauty brands have closed down one after another due to poor management.

According to the incomplete statistics of the retail research center of Lianshang.com, in 2023, at least 27 beauty brands in the domestic market announced their closure or adjustment.

Although the market is cold, the beauty industry can’t escape the word "volume".

The competition in the domestic beauty market has intensified, and the whole beauty market has become saturated. The rise of more and more domestic new brands has brought consumers more choices, but it has also led to the industry’s "scouring sand" over and over again.

The industry is gradually evolving towards maturity through the survival of the fittest.

Mao Geping’s three-way IPO is finally defeated

In the domestic cosmetic industry, "Mao Geping" is a fairy-level existence.

In 1995, a TV series "Wu Zetian", starring Liu Xiaoqing, played Wu Zetian from the age of 15 to over 80, which was a great challenge for Liu Xiaoqing.

It was a challenge to the makeup artist of the crew, because Liu Xiaoqing was 40 years old at that time. But Mao Geping accomplished this task brilliantly, and with the fire of Wu Zetian, Mao Geping became an instant hit. Since then, the makeup design of the Beijing Olympic Games ceremony has further added his aura.

The makeup skills comparable to "head-changing" have made it frequently hot search, which once detonated 600 million readings overnight.

Thanks to its superb skills and flow blessing, "Makeup Artist Mao Geping" has gradually evolved into "Brand Mao Geping". In 1998, Mao Geping founded Mao Geping Cosmetic Art Co., Ltd. in Hangzhou. He published his makeup experience into a book and toured more than 60 cities across the country to give lectures.

In 2000, Mao Geping founded "Mao Geping Image Design Art School" in Hangzhou. Since then, he has opened branches in Beijing, Shanghai, Shenzhen, Chengdu, Zhengzhou and other cities. Mao Geping’s "ambition" goes beyond this.

In the same year when he opened the school, he set up "MAOGEPING Cosmetics Company", and launched a mid-to-high-end beauty brand named Mao Geping.

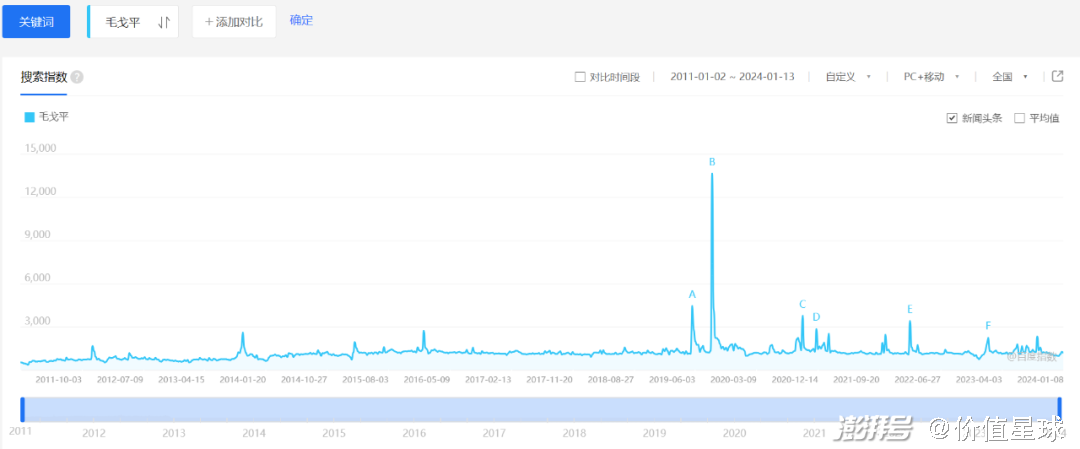

Searching Baidu Index with "Mao Geping" as the key word, 2019 is the highest search volume of "Mao Geping" for more than ten years since 2011.

"Mao Geping" Baidu Index. Source: Baidu Index

In 2019, at that time, some netizens uploaded a series of makeup tutorials that they shot many years ago in bilibili, as well as a video of Mao Geping’s modification of amateurs on the show. However, "Mao Geping" hasn’t been tied up with "head-changing" yet. It’s just that some netizens joked in the comment area, "Where did you buy the teacher’s hand? Or send my head. "

Until August, 2019, Weibo famous fashion blogger @ Late Night xu teacher posted a "Mao Geping Makeup Video" on the Internet. As soon as this video came out, it was almost as hot as a search, and the forwarding volume reached 100,000 that night, and the reading volume also exceeded 100 million. All the people watching it were exclaiming Mao Geping’s "ingenious pen". Because the blogger described this as a "cosmetic makeup", "head change" was named after it.

It is worth mentioning that during 2019, when Mao Geping became popular on the Internet, "Brand Mao Geping" also made an IPO sprint behind her back.

This is a "long" IPO journey. As early as December 2016, Mao Geping Company submitted the prospectus, and the process has not moved forward since then; Until September 2017, Mao Geping Company updated its prospectus; In October 2021, Mao Geping’s initial listing application was approved, but the listing process was put on hold again.

In March 2023, Mao Geping Company updated its prospectus again. However, due to the expired financial information, its audit status was changed to "suspended (financial report update)" on September 30, 2023. Until January 4, 2024, the Shanghai Stock Exchange officially terminated its IPO process.

From the data point of view, as one of the companies that entered the beauty track earlier, Mao Geping’s data is not bad. According to the prospectus, from 2020 to 2022, Mao Geping’s revenue and profits both increased. In the past three years, it has achieved revenues of 880 million yuan, 1.43 billion yuan and 1.68 billion yuan respectively, and its net profit has increased from 198 million yuan in 2020 to 349 million yuan in 2022.

In the same period, the company’s comprehensive gross profit margin was 81.20%, 80.54% and 81.17%, which was higher than many international giants such as L ‘Oreal and Shiseido, as well as well as well-known domestic brands such as Polaiya and Betani.

However, the comprehensive gross profit margin of Mao Geping is higher than the industry average, but the R&D level is lower than the industry average. In the same period, the R&D expense rates of Mao Geping Company were 1.21%, 0.96% and 0.87% respectively. The R&D expense rate of enterprises in the industry is mostly between 2% and 5%.

In this regard, Mao Geping explained that the average level of R&D is relatively low, mainly because of the differences in R&D modes and stages. "Paying attention to the industry accumulation and practical experience of R&D personnel has the characteristics of less material input and less equipment demand".

However, in the same period, the proportion of marketing expenses to operating income was 42.09%, 42.07% and 46.74% respectively.

Mao Geping, whose cost structure shows a trend of attaching importance to marketing but neglecting R&D, failed to harvest an IPO after seven years’ tossing and turning.

Bankruptcy, suspension, closure, beauty under the altar.

Looking back at the whole year of 2023, we will find that the "listing fever" in the beauty industry has gradually "cooled down", and Mao Geping is not the only beauty company that has sunk in the secondary market.

Beauty brand Misifu, Franlinka’s parent company Huanya, raw material company Pai Peptide Bio, and beauty agency Laramie all announced the suspension of IPO.

At the same time, a number of brands have emerged on the beauty track that are either struggling to survive or officially withdrawing.

Just a month ago, the announcement of the National Enterprise Bankruptcy Reorganization Case Information Network showed that the Shanghai No.3 Intermediate People’s Court officially accepted the case that Zeping’s parent company Shanghai Huayimei Cosmetics Co., Ltd. was applied for bankruptcy liquidation, and Huayimei officially entered the bankruptcy liquidation procedure. In December 2023, Hangzhou Museum Brand Management Co., Ltd., the parent company of the new beauty retail species Only Write, was also filed for bankruptcy liquidation by creditors because it could not pay off the debts due.

Source: pexels

There are still many unsustainable beauty companies. According to the incomplete statistics of the value planet, at least 10 well-known local cosmetics enterprises/brands will go bankrupt, close down and close their stores in 2023. In addition to Hua Yimei and Only Write, there are It’s Focus, Kale said Colorpedia, Happimess enjoyed it, Scentooze Three Rabbits, Floating Fomomy, Mushrooms, Shaohuo, Rock Zoo and so on.

Under the cold market, not only domestic local beauty companies, but also overseas brands have "lost" the China market.

An incomplete statistics of Jumeili in October, 2023 shows that since 2022, 21 overseas beauty brands have withdrawn from the China market, and 5 group brands have adjusted their strategies in China and narrowed their channels. These include Procter & Gamble’s skincare brand First Aid Beauty, American affordable makeup brand e.l.f, Amore Pacific Construction Group’s Yueshi Fengyin, and L ‘Oré al Group’s Maybelline. They were all the rage in China market or occupied China market for many years, but they all ended up in this once scenic market.

In addition, the overseas flagship stores of some brands have also been shut down. In December, 2023, Japanese makeup brand CEZANNE Qian Shili and Korean makeup brand BBIA Tmall overseas flagship store announced that they would not accept new orders from now on.

In the same month, the first batch of Korean makeup brand papa recipe (Chunyu) entered the China market, and its China marketing agent Shenmei Group also issued a notice about the cessation of operation of papa recipe brand in China.

The rolled-up beauty track has to be watered with money.

On the other hand, the capital boom in the beauty industry in previous years has also stepped on the brakes.

In 2021, the fire successively captured the financing of the beauty protection track, which failed to capture the hearts of investors since 2022. The data shows that the primary market in 2022 was significantly lower than that in 2021, and the amount of financing decreased by 58.82% year-on-year.

In 2023, with the economic operation showing a good trend of recovery, the retail market has gradually stepped out of the upward curve, and the eyes of capital are also closely watching the performance of the retail market. In the beauty track including beauty brands, raw material manufacturers, beauty platforms and agents, there were still nearly 50 financing events during the year, but most of the enterprises that got financing were raw material manufacturers, and the brands were almost in a state of no revenue.

Capital is often profit-seeking. What is reflected behind the slowdown of investment and financing and the obstruction of listing is actually the slowdown of market growth.

According to the data of the National Bureau of Statistics, from January to November 2023, the total retail sales of social consumer goods was 42,794.5 billion yuan, a year-on-year increase of 7.2%. Among them, the total retail sales of cosmetics was 384.3 billion yuan, up 4.7% year-on-year, which is still far from the average annual growth rate of more than 10% at the peak period. At the same time, the total retail sales of cosmetics in November was 54.8 billion yuan, down 3.5% year-on-year, and the growth rate was lower than that of the broader market.

Source: pexels

Parallel to the slow growth of the total retail sales of cosmetics, the overall downturn of the track.

Before 2021, under the background of "consumer investment fever" in the capital market, more and more domestic beauty brands sprang up like mushrooms after rain, with the help of capital and the help of live broadcast, and the domestic beauty track was up.

Under the touting of capital, a large number of beauty brands that started from OEM or OEM mode have entered the eyes of consumers. Someone has summed up the "three axes out of the circle" of new consumer goods-5,000 little red book notes, 2,000 Zhihu questions and answers, and a super-head anchor to bring goods.

Domestic beauty brands are all like this, and they have concocted "brand out of the circle" again and again.

At the same time, the problem of product homogeneity in the market is becoming more and more serious.

The founder of the floating Fomomy, who closed down in early 2023, once pointed out, "The ideal state is that the emerging domestic cosmetics brands bet on the new products, and the heat is still there, and the plagiarism has not spread. After selling the new products, they will definitely gamble at the table. It is possible to make money. However, human nature is always greedy, and the speed at which e-commerce explodes will make people miscalculate the best-selling products, so the first reaction of merchants is to replenish goods and continue production. But at the same time, human nature likes the new and hates the old. It takes time for the production of goods. When the replenishment is completed, this single product may be outdated, resulting in unsalable sales and inventory. "

In order to get rid of homogenization and prevent plagiarism, beauty brands invariably choose to rely on strengthening research and development to improve product strength and brand strength.

But obviously, to "strengthen research and development" requires "money".

Looking at the beauty brands in the industry that rely on capital, they can’t even be self-financing. Nowadays, it is even more difficult to get listed in the primary market and the secondary market. "Survival" has become the primary goal, but under a series of measures to reduce costs and increase efficiency, such as layoffs and cutting R&D expenditures, the brand’s problem of "emphasizing marketing and neglecting R&D" has only become more prominent.

The beauty track is speeding up its clearing, and it is out of date to rely solely on marketing in the past. At the present stage of capital "transfusion", how to build a core technical barrier with limited resources and establish brand trust advantage has become the key to whether domestic beauty brands can continue to write the previous "myth".

In the movie Alice in Wonderland, the Red Queen has a line, "You must try your best to keep running to stay where you are", and so does the business world.

* This article is written on the basis of public information, only for information exchange, and does not constitute any investment advice.